OPERS Essentials: PLOP

Here’s how to receive a lump sum payment when you retire

By Michael Pramik, Ohio Public Employees Retirement System

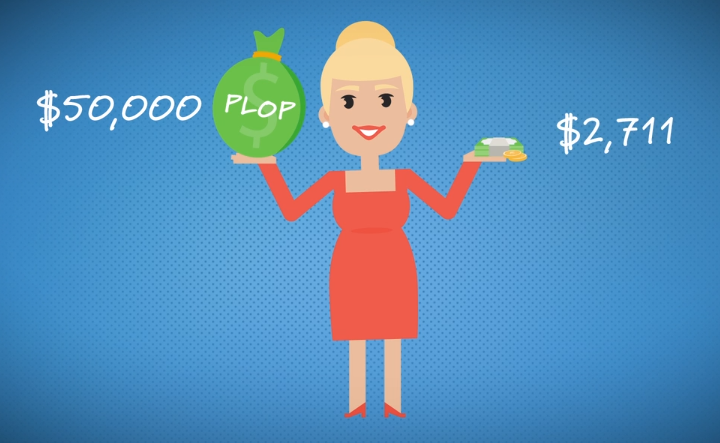

March 5, 2019 – Most OPERS members can cash out a portion of their pension as a partial lump sum option payment, or PLOP, when they retire. How does this option work? Watch the latest video in the OPERS Essentials series, which explain various features of your OPERS retirement plan.

You can view all of the OPERS Essentials videos on our YouTube channel.

Michael Pramik

Michael Pramik is communication strategist for the Ohio Public Employees Retirement System and editor of the PERSpective blog. As an experienced business journalist, he clarifies complex pension policies and helps members make smart choices to secure their retirement.

Nice video, Michael. Regarding the 10% withdrawal penalty if under age 59 1/2: Is that only if I withdraw it early from an IRA later on before that age? In other words, if I just take a PLOP on retirement directly into a bank account at say age 54 does that get penalized?

Tom,

It could, as the IRS has various rules that come into play. Read the Special Tax Notice on our website for more information. The IRS has a chart on early distributions on its website.

For more assistance, you can talk with a tax adviser or see IRS Form 5329.

Michael,

Can I take a lump sum before I retire?

Mr. Paxton,

Good question — you’re not the first to ask. We receive this question periodically.

You cannot withdraw funds or borrow against your OPERS account. You can, however, refund your contributions after leaving OPERS employment. For more information about refunding your account, go to the OPERS website at https://www.opers.org/members/refunds.shtml.

Julie, OPERS

Tom,

I am looking to retire next year at 55, if I take a plop and have the money go directly to an IRA does it still get penalized or is the penalty only if the money is directly deposited into your personal checking or savings account?

Thank you, Sean

Sean,

If you receive a payment from a tax-deferred retirement plan before the age of 59 ½ and you do not roll it over to another qualified retirement plan, then in addition to regular income tax, you may be subject to an early withdrawal penalty by the IRS which is equal to 10% of the taxable portion. There are some exclusions to this early withdrawal penalty even if you take the distribution directly, but the exceptions vary for different types of retirement plans. One of the exclusions that applies to OPERS payments is if you are age of 55 or older in the year you separate service. To find out more about your personal tax liability those exclusions from the 10% penalty, you can talk to a professional tax advisor.

Any portion that you rollover to another qualified retirement plan is not taxable.

Julie, OPERS

Is plop available to disability retirement

A PLOP is available only for those retiring from the Traditional, Combined or Member-Directed Plans.

I am retiring 02/01/2020. When can I expect my PLOP payment? I received a letter stating no sooner than 90 days after my first monthly benefit, which says I won’t receive that for 30-45 days after I retire. Am I reading this correctly? Do I really have to wait 1.5-4.5 months before I see any income?

Any info is greatly appreciated.

Thanks

You will receive your first benefit payment approximately 30 business days after we receive all valid documentation from both you and your employer, or your retirement effective date, whichever is later. If you chose a partial lump sum option payment, or PLOP, it will be released 90 days after your first benefit check.

Julie, OPERS

Can you return full or partial PLOP should you later decide that you no longer need it, and would your monthly benefit be re-calculated?

Once you have retired, you can’t change your payment plan unless there is a life-changing event, such as the death of a spouse or a marriage if you chose a single life annuity. You cannot “cancel” a PLOP and return the money to OPERS.

Julie, OPERS

I don’t think too many OPERS members know about the 100% Refund Option of their pension contribution plus up to 67% depending on years of service. At least, I did not know that until recently. This refund option is akin to a lottery winner opting for a lump sum instead of a 20 year annuity. An OPERS retiree may opt for full refund instead of receiving monthly pension as long as he or she lives. This option may be good for a smart/astute investor/retiree who believes he or she can invest his/her refund and earn enough return to pay himself/herself pension for as long as he/she lives. OPERS is basically doing the same thing on a large scale. It is investing retirees money and paying them guaranteed monthly pension from the returns on money invested.

If you refund your account, you will receive 100 percent of your member contributions. You may also be eligible for an additional amount depending on your retirement plan and years of service. Your account may be subject to federal and/or state taxes unless you roll over your account to another qualified retirement plan. More information is available on the OPERS website, https://www.opers.org/members/refunds.shtml.

Do you get all the employer contributions or just the employee contributions?

The annual report illustrates the minimum/maximum amount of a PLOP and the effect on the monthly pension. Has OPERS considered a calculator to assist in determining the amount of PLOP other than the minimum/maximum an employee would like to have distributed and the effect on the monthly pension?

If you refund your account, the amount of employer contributions you will receive depends on your retirement plan and years of service. You can find more information through our refund estimator at https://www.opers.org/members/refunds.shtml. (Scroll down to “Do I get all my money back when I refund?”)

There are several rules regarding the PLOP, so we recommend that if you are thinking of choosing this option at retirement to contact us.

Julie, OPERS

Yes- there is a custom tab that you can enter any amount between the Minimum and the Maximum to get an estimate of your benefits.

Does it typically take 90 days to receive your PLOP after receiving your first retirement check. Because of the ongoing Covid-19 pandemic in Ohio, can you request to receive your PLOP within the first 45 days after your first benefit payment?

For further assistance please contact OPERS through the online account message center or by contacting us at 800-222-7377.

My mom and former co-worker received their PLOP within 45 days after 1st benefit payment. Is that the norm or will I have to wait the 90 day period. I’m still confused as to why their is a 90 day waiting period. Please advise…

The PLOP is issued no sooner than 90 days after the first benefit is paid. If you have additional questions please forward them through the online message center so we can review your account and provide account specific answers.

Well it’s 90 Days after I recieved my 1st Retirement payment , but I didn’t get my PLOP , I called and the Girl said that there was no Payout Date on my Account…..I know COVID has made things difficult but still this is messing up my plans to pay my House off …pretty disapointed.

We are only able to provide general information in this comment, if you need assistance please contact OPERS at 800-222-7377 or send a secured message through our online message center that is available through your online account. Our Member Services department will be able to help assist with your questions.

It’s been 90 Days since I retired and I haven’t gotten my PLOP . I called OPERS and was told there was no pay out date on myt Account , shouldn’t that be 90 Days for anyone/ Everyone ?

I assume this is an oversight , but still I can’t help but be disappointed , what do You suggest ?

For further assistance please contact us through your OPERS online account message center so we can review you account specific information or contact us at 1-800-222-7377.

What does PLOP effective date mean?

There is not a plop effective date the plop is issued no sooner than 90 days after the first retirement benefit is paid.

If a PLOP is rolled over to Ohio Deferred comp, is it still penalized if younger than 59 1/2 years old?

What is the benefit of doing this?

Gary,

Please forward your questions through the Member Online Account that is available through our website. Through the online account we will be able to review your account and provide an account specific answer. I have emailed you a copy of the special tax notice that provides some additional details about distributions from OPERS and the tax and penalties. Thanks MS

When I retire, may I have my PLOP amount be directly deposited into my wife’s Roth IRA?

Tony, No, PLOP payments may be rolled over into another qualified retirement plan in the member’s name. Also PLOP rollover payments are sent via a paper check.

Hi, I’m considering a plop. My exspouse through court order. Get 50% of my retirement. For the 9 years & 1 month we were married. I’m considering a $75000.00 plop. What percentage of my plop would my ex spouse receive?

Robert, for better assistance please contact OPERS directly at 1-800-222-7377. Thank you, OPERS

Hello, in example – it seems like the $55,000 PLOP would reduce her pension by $314 per month or $3768 per month, and then assuming annual COLA of 2% would result in $75.36 less per year in COLA from year 64 to Year 85 (assuming death at 85)…so the $55,000 would cost her $3768 X 23 = $82,896 and loss of COLA $75.26 per year which would be $1733 per year less at age 85….so totaling $20,799 or over $100,000 over her life in less pension dollars…is that correct? (this does not take into account time value of money…just how much it costs to take a plop). It seems very expensive to take a plop. The entire cost is 6% cost using time value of money. Assuming 2% COLA per year. Does this seem correct?

Cam,

It is true that if you receive a PLOP your monthly benefit is reduced. COLAs are based on the initial retirement annuity benefit, which would be lower with a PLOP than if the lump-sum payment was not taken.