OPERS releases COLA Essentials

Video series to address member questions about the proposed changes

By Michael Pramik, Ohio Public Employees Retirement System

Oct. 3, 2017 – The Ohio Public Employees Retirement System has released OPERS COLA Essentials, a video series that will address common questions we’ve heard from members as we consider changes to the annual cost-of-living adjustment.

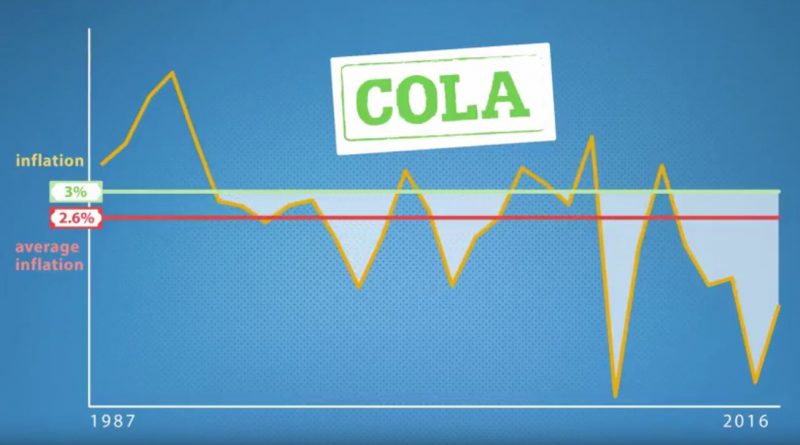

The initial video explains the relationship between the COLA and the U.S. Consumer Price Index, the costs of the COLA and the difference between simple and compound interest as they relate to the COLA.

For more information, including a full set of Frequently Asked Questions, refer to the OPERS COLA page.

https://youtu.be/T7knzWCq0hU

Michael Pramik

Michael Pramik is communication strategist for the Ohio Public Employees Retirement System and editor of the PERSpective blog. As an experienced business journalist, he clarifies complex pension policies and helps members make smart choices to secure their retirement.

I cannot find the chart that listed what percentage of the monthly health allowance you get based on your age and years of service. Please tell me where to find it. Thanks.

Ms. Grote,

Thank you for your question. I believe you are referencing the chart in the Comprehensive Guide published several years back; however, that publication is no longer in circulation. You can do one of two things: 1) Go online to do an estimate based on your years of service. This will show the allowance amount, not percentage.

Please call us at 1-800-222-7377 if you have additional questions.

Julie, OPERS

please leave cola alone

How about someone watch this video and give us a two or three line recap without all the fluff. Thanks.

P B Pramik has a new video reference COLAs on the OPERS Perspective website.

Ok let’s review. Here are a few points to consider. For OPERS retirees under 65 years old ; OPERS eliminated the spouses healthcare payment. OPERS warns us that healthcare for OPERS members is not guaranteed. Warning that OPERS retirees could lose their healthcare at anytime. The cola is going to be reduced more than likely. The years to work has been changed from 30 to 32 years. For those of us over 65 our spouses health care saving deposit will be eliminated in 2018. When will all these reductions stop?

We are not keeping up with inflation .

Thank you for the above video. I also reviewed the communication from 9/22/17 covering OPERS BOARD continued discussion of options for changing the COLA. I am in favor of continued consideration concerning CPI based COLA subject to a cap less than 3 percent and extending the waiting period for the first COLA for new retirees, but NOT a flat dollar amount COLA.

I would like to see OPERS compare “apples to apples” . It appears that your graph STILL compares Compounded CPI to individuals fixed 3 %. I am sure you have the total of all COLA payments for each year to retirees and a total of all “total pay outs for each year for retirees” . It would be interesting to see what that looks like if you used the % of COLA paid each year compared to total retirement paid. As your retirees are trying to tell you please compare apples to apples.

Daniel can check CPI calculators on line that will verify that when the CPI is compounded for the periods of time that OPERS is using for their statistics, the answer is the compounded CPI would yield more than the fixed 3%.

I appreciate that OPERS works to sustain the financial viability of our fund. However, all retirees are already enduring significant increases to our health insurance costs due to previous OPERS changes to that end. Incidentally, OPERS led us to believe that these changes would put us on solid ground unless the economy took another hit. Now, though, despite a growing economy, OPERS says we still face a shortfall and must endure reduced COLAs on top of increased insurance costs. I retired after 2012, so already am concerned that my COLA will soon be based on the CPI-W. Now, my 3% cap may be reduced and those who retired prior to 2012 will lose their fixed 3% COLA???

OPERS, please take note that the CPI-W, on which OPERS and Social Security use to determine COLAs, caps, etc., is woefully inadequate to meet the financial needs of retirees. For example, according to Investment News (Oct. 24, 2016), the CPI-W excludes spending patterns of people over the age of 62. This means it does not include things like rising Medicare premiums. The article also explains that the CPI-W gives less weight, overall, to medical costs, which climbed by more than 7% in 2016. Yet, Social Security’s COLA for that year was only .3%. That isn’t a typo; the CPI-W-based COLA in 2016 was only one third of one percent!

All OPERS retirees will now be in the same boat, struggling with rising healthcare costs that far outpace a shrinking COLA. To be frank, it’s unconscionable to use the low rates of the CPI-W as an excuse to give less money to retirees when insurance and healthcare costs continue to rise at an alarming rate.

I urge OPERS NOT to use the CPI-W as an indicator for COLA adjustments. Period. The Senior Citizens League, a retirees’ advocacy group, recommends the CPI-E (Consumer Price Index for the Elderly) be used instead. What if instead of a fixed 3% COLA for those who retired prior to 2012, the COLA for ALL retirees (current and future) is based on the CPI-E? The CPI-E in 2016 was 2.1% and was based on a basket of goods much more comparable to what retirees must spend their money on. OPERS will still save money and your retirees will receive a COLA that will better keep pace with their actual expenses.

OPERS has used the CPI-W since it established the COLA in 1970. This index is the measure used by the Social Security Administration as well as other pension systems. Some pension systems use the CPI-U as a basis for their COLA. There’s also an experimental index called the CPI-E, designed for elderly costs. No pension system uses the CPI-E for COLAs. Comparative data shows that all three indices are comparable.

Julie, OPERS

Who is the bearded man in the video, Santa Claus? It seems he is leaving us retirees a lump of coal in our stockings this year!

Well said.

Ok when a OPERS retiree passes away , the spouse of that retiree will no longer receive a monthly health saving account deposit. Am I correct ? Is that fair? Well ?

Any outstanding, qualified medical expenses in the your name can be submitted to your Health Reimbursement Arrangement for reimbursement up to 24 months following your death. If there are funds remaining after those expenses are paid, eligible spouses and dependents can submit their qualified medical expenses to your HRA for reimbursement until the funds are exhausted. To gain access and utilize the remaining HRA balance for a deceased or incapacitated beneficiary, authorized caregivers should contact OneExchange for next steps and guidance.

Julie, OPERS