‘Popular’ report simplifies financial info

Shorter version of OPERS’ annual report is easier to understand

By Michael Pramik, Ohio Public Employees Retirement System

July 13, 2022 – Last week we told you about the latest OPERS Annual Comprehensive Financial Report, the deep dive into the workings of your pension system.

If a 222-page document seems to be a bit too much to digest we suggest reading the 2021 Popular Annual Financial Report, a compact document that OPERS also produces annually. This report hits the highlights of the previous year’s accomplishments in several categories, including investments, demographics, benefits, health care and income/expenses.

Important activities in 2021 included:

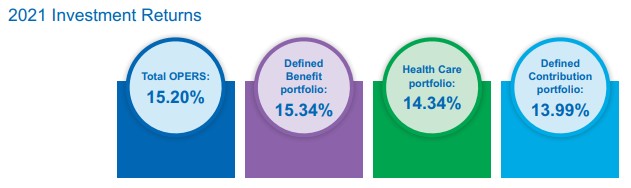

- Investments: Total investment returns were 15.34 percent of the Defined Benefit Fund and 14.34 percent for the Health Care Fund. Over the past three years, those portfolios’ combined net returns added up to more than $45 billion.

- Funding status: OPERS’ funding improved last year to 84.1 percent from 81.5 percent. That reflected the strong investment performance one year after OPERS adjusted our investment earning assumption from 7.2 percent to 6.9 percent.

- Health care: Recent adjustments to the way OPERS delivers health care have helped us boost that plan’s funded ratio to 110.4 percent and solvency period to 25 years.

- Combined plan changes: Beginning this year, OPERS consolidated the Combined Plan under the Traditional Pension Plan, closing the Combined Plan to new hires.

Statistical highlights are presented in easy-to-read graphical ways. For instance, you don’t have to dig into the document to see our investment returns.

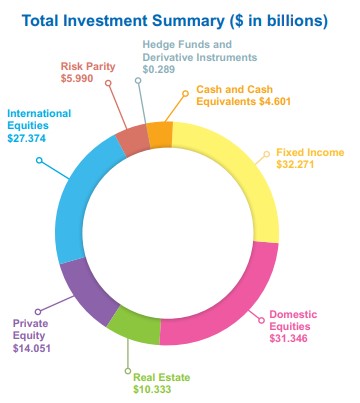

Similarly, our total investments are easy to see at a glance with an investment summary presented in the 2021 Investment Overview section.

The PAFR also includes some interesting statistics about our members. OPERS has more than 290,000 actively contributing members and nearly 3,700 employers who remit contributions on our members’ behalf. Our members work for the state of Ohio, its 88 counties, numerous municipalities, libraries, townships and villages. We also have 236 law enforcement/public safety employers, another statistic presented in the popular report.

Over the past 10 years, the pension benefits we pay to retirees has increased every year. In 2012 we paid $4.6 billion in benefits, and last year those benefits totaled $6.8 billion. That’s nearly a 50 percent increase. You can see where those benefits are distributed – the report contains a map of all 88 counties that indicates pension payments, employer payroll and the number of active employees and retirees by county.

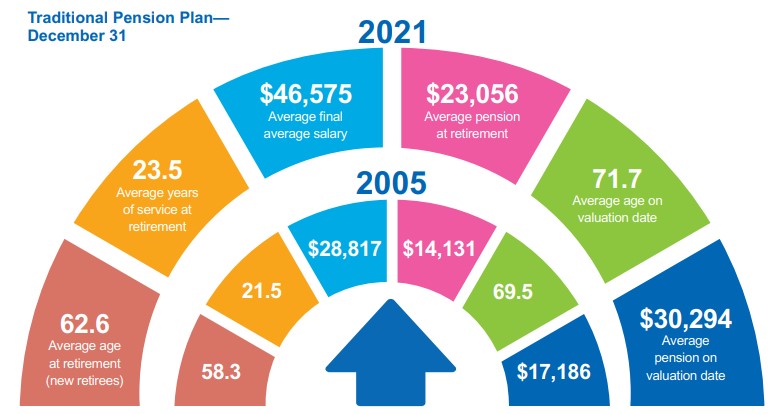

Those average retiree pension benefits also are on the rise. For instance, a graphical presentation of that information reveals the average pension at retirement has risen 63 percent, to $23,056, over the last 15 years.

OPERS is good for Ohio, and the popular report points that out in no uncertain terms. For every dollar that our public employers contribute, $3.48 is returned to the Ohio economy. Further, $2.6 billion in OPERS assets were invested last year with Ohio-based companies, and $1.2 billion is managed by Ohio-qualified investment managers.

The popular report is a great way to see how your pension system performed last year. It’s also a fine way to introduce new members and stakeholders to all the things OPERS does to help deliver retirement security to our 1.2 million members.

Michael Pramik

Michael Pramik is communication strategist for the Ohio Public Employees Retirement System and editor of the PERSpective blog. As an experienced business journalist, he clarifies complex pension policies and helps members make smart choices to secure their retirement.

Pension rates may have increased; however, the average age of retirement has also increased which means OPERS will be paying benefits for fewer years. Life expectancy is not increasing. Nice, informative article.

CherylH

Does OPERS have a funding percentage goal? Is there a legal requirement as to a funding percentage? If not, what do you consider to be an adequate funding ratio for a public pension fund?

Michelle,

There is not a legal requirement for the funded ratio. Our goal is 100 percent funding.