Answers to OPERS member questions

This month: Learn about HRA deposits for 2024, investment info and more

By Michael Pramik, Ohio Public Employees Retirement System

June 29, 2023 – Members and retirees often ask us questions through our social media channels that others could benefit from. Periodically we post these questions and answers in our PERSpective blog.

This month we’re addressing questions about HRA deposits and the claim process, how to find investment information on the OPERS website, and how service credit works for OPERS law enforcement members.

Q: I have a Health Reimbursement Arrangement for my health care. Will my HRA deposit amounts be changing in 2024?

A: No. HRA deposits will remain unchanged for 2024. As a reminder, OPERS funds the HRA for eligible benefit recipients. Administered by Via Benefits, the HRA is an account that provides tax-free reimbursement for qualified medical expenses such as monthly post-tax insurance premiums, deductibles, co-insurance and copays incurred by eligible benefit recipients and their dependents.

OPERS funds HRAs with a monthly deposit. The amount of the deposit is a percentage of a base allowance amount. The amount of the deposit is determined by your years of qualified health care service credit as of your retirement effective date, and your age when you first become eligible for the HRA.

For Pre-Medicare benefit recipients the base allowance is $1,200 per month, and for Medicare recipients the base allowance is $350 per month. Allowance percentages range from 51 percent to 90 percent of the applicable base allowance.

Your individual monthly HRA deposit amount is provided on your annual Open Enrollment statement. If you’re a new benefit recipient, the amount will be provided in your health care confirmation letter.

Q: I am interested in reading the investment policy established by the Board of Trustees. Can that policy be made available to retirees?

A: All of our investment policies, as well as the current investment plan, are posted on our website. OPERS Investment Division management and staff create the annual investment plan, which defines the division’s yearly goals. The OPERS Board approves the target asset allocation for both the Defined Benefit Fund and the Health Care Fund.

Q: I’m a member of OPERS, in the law enforcement division. What types of service credit are available to members like me?

A: While purchased service can be used in the calculation of regular OPERS benefits under the Traditional Pension Plan and the defined benefit portion of the Combined Plan, only certain types of service credit may be used in the calculation of a law enforcement benefit under the Traditional Pension Plan.

The service credit used for calculating a benefit for law enforcement and public safety officers can include up to four years of free military service and up to five years of purchased military service. Members also may purchase full-time, out-of-state or federal law enforcement service. However it may not be used in the calculation of a law enforcement or public safety officer’s benefit. Purchased or transferred service credit earned as a police or highway patrol officer in Ohio can be included in a benefit provided the credit is not being used to qualify for another pension.

For more information, refer to the Law Enforcement/Public Safety Officers leaflet, and the Service Credit and Contributing Months leaflet.

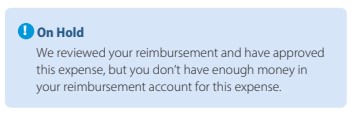

Q: I’ve noticed that one of my HRA refund claims has been put on hold. What does that mean, and why did it happen?

A: Most times when an HRA reimbursement is put on hold it’s because the retiree’s HRA balance for the month has been exhausted. There aren’t funds available to pay the claim until the next monthly deposit is received.

Retirees will receive the following message when they submit an online claim but do not have enough money in their HRA to be reimbursed:

Any amount that exceeds the balance in the HRA will show in the Via Benefits online account Dashboard as “Payments on Hold.” Payments on Hold are grouped by the expense year. Via Benefits will send reimbursements as soon as the funds are available, paying the oldest claim first.

Michael Pramik

Michael Pramik is communication strategist for the Ohio Public Employees Retirement System and editor of the PERSpective blog. As an experienced business journalist, he clarifies complex pension policies and helps members make smart choices to secure their retirement.

base allowance is $350 per month. For Medicare recipients percentages range from 51 – 90 % of the applicable base allowance. Is there any group that earns more than 90%? And if not how was the $350 allowance derived at? Thanks

Lhish,

As stated in the blog, the allowance range is from 51 percent to 90 percent. With staff input, the Board of Trustees OKs the base allowance amount.

Here is part of a blog post from 2021 that explained the change in the base allowance to $350 monthly:

Offering health care coverage has become increasingly expensive as health care rates have risen dramatically and member demographics have shifted. To preserve the OPERS Health Care Fund for current and future retirees, OPERS took a careful look at all aspects of the health care program to identify impactful changes. Keep in mind that the HRA allowance was never intended to cover the full amount of costs that a Medicare retiree may incur.

On an annual basis, OPERS staff reviews HRA utilization with the Board of Trustees. When considering the value of the Medicare base allowance amount, OPERS staff and the Board discuss the average HRA balance and how much Medicare plans cost. On average, a Medicare retiree carries a balance in their HRA from year to year.

Even though the base allowance amount has been lowered, Medicare retirees should still have sufficient funds within their HRA to cover their supplemental Medicare plan premiums and some will have additional funds for other qualified medical expenses.

I retired from ODH in Sept 21 with a OPERS monthly pension. If I was offered a part time position with OSU and would be covered in a part time OPERS POSITION would I loose my monthly OPERS monthly pension.

David,

Re-employment in an OPERS-covered position doesn’t mean you would lose your pension benefit. Read our “Returning to Work After Retirement” leaflet carefully, and contact us at 800-222-7377 if you have any questions.

During the next health care open enrollment period (Fall of 2023) are Via Benefits advisors going to offer or at least provide information on chosing BC/BC of Michigan (a PPO) that other OPERS retirees are currently using and are raving about on an OPERS Facebook page; instead of only offering the high deductible HMO Marketplace choices? If there are other alternatives to the Marketplace, recipients should be made aware so good choices can be made.

David,

Please contact Via Benefits for that information, at 844-287-9945.

I am a retired employee from UC. I would like to work a part time as an independent contractor for UC Special events approx. 15hrs.per month 8 months out of the year. Can I work without losing my benefits,.

Eileen,

A retiree cannot continue to receive benefits and work as an independent contractor under a contract for any period of time for the employer from which they retired. This prohibition is applicable regardless of the number of hours or days actually worked. If this occurs, the pension portion of the benefits will be forfeited and the annuity portion of the benefits suspended for the entire period of service as an independent contractor. Benefits may continue if the retiree is providing services as an independent contractor for another public employer.

More information about working as a contractor can be found in our “Returning to Work After Retirement” leaflet.

I am a surviving spouse and I have remarried. If I get divorced will my husband be entitled to half of my benefits.?

Sandy, for further assistance, please contact OPERS directly at either 1-800-222-7377 or submit your inquiry through the online Message Center at opers.org. Thank you, OPERS

This is a question instead of comment. When HRA is on hold and the debt is growing how does a person get this caught up and paid down. I the person dies before enough money is put in HRA to cover expenses, what happens to debt. This bothers me.

Retirees can receive HRA reimbursements for eligible medical expenses as long as the HRA funds are available. If the submitted HRA reimbursement claims exceed the HRA balance the reimbursement claim cannot be processed as the funds are not available. The unprocessed HRA claims due to lack of funds are not debt because the medical expenses were initially paid prior to the submission of the HRA claim. Please contact Via Benefits at 1-844-287-9945 for further assistance with your HRA.

Every month the amount of money I have on hold increases, is there a limit on this?

Lyndon, please send your question through the online account message center so we can provide account specific answers, or you can contact our Member Services Center at 1-800-222-7377 for further assistance.