Under the surface of the U.S. economy

OPERS economist: Things aren’t as rosy as they might seem

By Michael Pramik, Ohio Public Employees Retirement System

Oct. 31, 2018 – Some believe that because the United States is in an economic expansion, and because the stock market is booming, that proposed OPERS plan design changes are unnecessary, too soon or too drastic.

One reader commented to the PERSpective blog recently, “The rate of investment return over the past 5 years makes (freezing a health care allowance) unnecessary.”

OPERS doesn’t make changes in one year based on market performance. We’ve talked about that quite a bit in the seven-plus years that PERSpective has been published.

But even if that were the case, what’s the true state of the economy today? Nick Kotsonis, a senior fixed income analyst and economist with the OPERS investment team, said recently that the economy might not be as robust as it appears on the surface. Let’s take a look why:

There is no doubt that the stock market is on an extended bull run. In the century-and-a-half from 1855 to 2007, U.S. economic expansions lasted an average of 39 months – nearly 60 months on average during the post-WWII era.

In November the U.S. economy will enter its 113th month of economic expansion since the prior recession ended in June 2009. That puts the current U.S. economic expansion as the second-longest in history, just seven months short of the record set in the 1990s.

However, while we have been fortunate to experience a very long and recession-free economic expansion, real (inflation-adjusted) GDP growth also has been the weakest in the post-WWII era. It has averaged only 2.2 percent since 2009, compared to an average growth rate of 4.6 percent during economic expansions since 1948.

Why has our economic growth underperformed so significantly during this cycle? It comes down to labor force growth and worker productivity, the building blocks of long-run GDP growth. Both variables have been severely depressed since the 2008 financial crisis.

The labor force participation rate is the number of people employed or actively looking for work, and the government measures this growth every year. From 1950-2007, it averaged 1.6 percent growth annually. We can infer from this that, without any assistance from productivity growth, the U.S. economy for decades could achieve a minimum of 1.6% annual GDP growth from demographics alone. However, since the Great Recession in 2008, annual labor force growth has averaged only 0.5 percent.

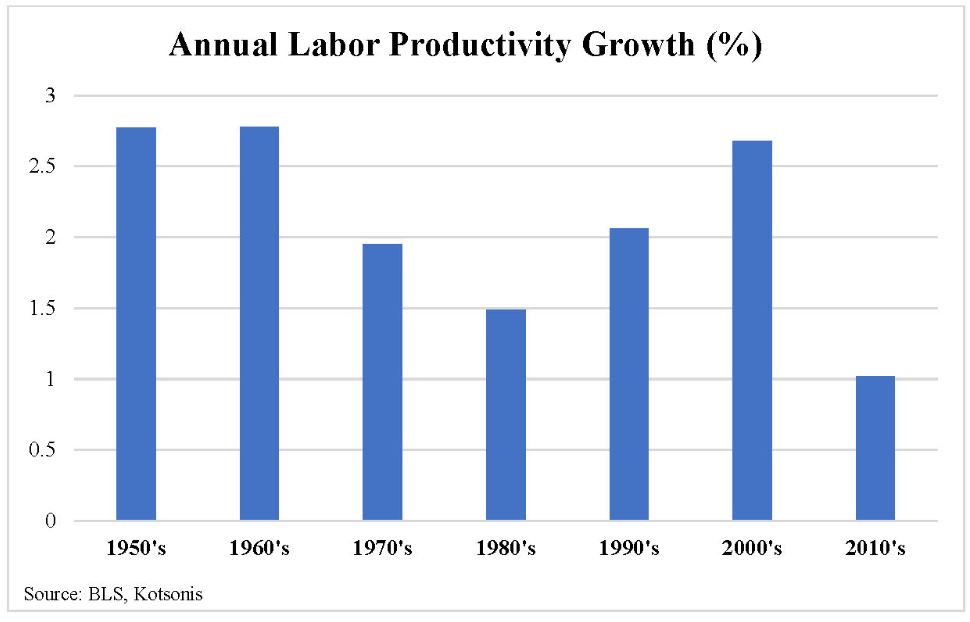

Therefore, we have lost more than 1 percent of potential GDP growth compared to prior periods just from an ageing labor force and declining labor force participation rates. The outlook for labor force growth is also not bright as the Congressional Budget Office projects, only 0.6 percent annual growth over the next five years. This projection is not overly controversial because demographic trends are not highly volatile in the short run. A more-important economic variable is productivity growth, or the measured output of the workforce. It’s driven by such things as labor efficiencies, technological change, returns to scale, labor composition, reallocation of resources and capital spending. Countries that achieve growth by labor force or population gains, rather than by better productivity, typically do not experience an improving standard of living.

Former Federal Reserve Chair Janet Yellen summed up this situation perfectly in a speech she delivered in January 2017: “This productivity slowdown matters enormously. With productivity growth of 2 percent a year, the average standard of living will double roughly every 35 years. That means our children can reasonably hope to be better off economically than we are now.

“But productivity growth of 1 percent a year means the average standard of living will double only every 70 years.”

Productivity is sagging because production growth during this business cycle has not kept pace with employment growth or hours worked across the labor force. One reason is that capital equipment spending has been weak since the 2008 financial crisis.

Unfortunately, productivity cycles tend to move in long, 20-to 25-year cycles, and we are in the 14th year of a downturn. While productivity growth will likely not remain weak forever, for our trend GDP growth to move back to a more normal 3.5 percent to 4 percent annual rate, we will need productivity growth to more than triple from current levels.

Given that productivity growth has never doubled over a preceding 10-year period since the 1950’s we have a difficult road ahead of us in terms of returning to an economic growth trend we were all once accustomed to.

Labor Productivity Growth in the 1950s reflected the period of enormous post-war production. This catch-up of civilian goods extended even into the 1960s, as your chart reflects. Information is welcome but the whiff of being set up for further reduction in benefits is not.

The purpose of providing the information in our most-recent blogs is to give you a sense of the challenges we’re facing, not as a prelude to benefit reductions.

I can’t help but agree with Jean’s opinion.

I have been a public employee for 30 years, and at the beginning I kept hearing how much better my situation was because I was part of OPERS rather than Social Security.

Just a few years ago, a representative visited our facility and talked about the Billions (“with a ‘B,’ he said) in the system.

Now, as I move closer to retirement, I’m hearing more and more about how hard times are and the “challenges” OPERS is facing. I realize economics is much more complicated than just whatever the Dow happens to be doing, but that complexity is what makes it possible to justify reductions in wages, benefits and health care, whether the economy is improving or crashing.

One thing I have NEVER heard from anyone who pays out wages or retirement benefits is, “The economy is doing so well we’re giving you a raise.”

What I have ALWAYS heard is more like, “You know, in THIS ECONOMY, we’re lucky to have the job and the pay we have.”

But the stock market is soaring! The economy is growing!

“Well, it’s more complicated than that.”

And the people at the top of the pyramid always come out just fine, regardless.

We know how important health care is to our retirees, but funding pensions is our first priority. In fact, in our entire 80+ year history, we have never missed a pension payment and fully intend to adhere to that tradition.

James, you hit the nail on the head. The people on the top of the pyramid make the decisions that affect the rest of us and always come out fine. And you will never see transparency about their salaries, bonuses and other perks while they continue to try to take benefits away from the rest of us.

Jean Chamberlin, I completely agree with your last sentence. A large amount of information is currently being sent to us via these OPERS messages. I think they’re setting us up for reduced benefits (both pension & health care) which I think was the plan all along. I understand health benefits have NEVER been guaranteed, but why don’t they just come clean with us instead of leading us along!

Mary,

The purpose of providing the information in our most-recent blogs is to give you a sense of the challenges we’re facing. Funding pensions is our first priority. If there is money left over, we can set aside those funds toward health care. The Board has begun a thorough review of the health care program. Continue to read the blog and your newsletter for more information.

Julie, OPERS

Couldn’t have been better put! Agree!! Thank you.

Are you looking at any recent stats? Just a question as the GDP has been considerably higher, some reporting 3.5%? We languished during the last administration and the negative impact of over restrictive, short sighted regulations. Just curious.

Your thoughts will be appreciated, I’m sure. Or is this just a response to the last burp in the stock market. A correction?

Thx.

All of the data in the article includes the most recent data.

Quarterly GDP growth, such as the third quarter result of 3.5%, is a quarter-over-quarter then annualized growth number. The GDP growth rate over the last 12 months is running at 3%.

Since the financial crisis in 2008, our one year rolling GDP growth rate has fluctuated between a high of 3.8% achieved in the first quarter of 2015 and a low of 0.9% achieved in the third quarter of 2011. The average has been 2.2%. The article outlines why the potential average is falling below 2% over the next five years.

There will be cyclical fluctuations above and below that average growth rate in the interim for a variety of reasons.

Julie, OPERS

I understand you are looking at predictions. But I have 36 years of service and 9 years from Medicare. I won’t have social security. I know quite a few people double dipping. Maybe you should stop all of these manipulations of the system. Perhaps you should just raise the service to 35 years since life expectancy is longer. But stop toying with us who have this on our doorsteps. You just announced yesterday regarding the healthcare and now you are looking at pensions. Wow! I think we deserve a bit more answers and not all of these dangling posts.

The purpose of providing the information in our most-recent blogs is to give you a sense of the challenges we’re facing. Funding pensions is our first priority. If there is money left over, we can set aside those funds toward health care. The Board has just begun a thorough review of the health care program. Continue to read the blog and your newsletter for more information.

Julie, OPERS

*sigh* What is OPERS going to take away from retirees NOW? This is unfair to ppl. whose income is FIXED.

Each new post from the PERSpective blog makes me feel less secure with my retirement. I appreciate updates but it seems each new post gives me greater concern that I may not be able to sustain retirement life. I worked under Social Security and qualified for my Medicare and pension that is offset by two thirds due to OPERS pension. I was informed by the Social Security Office I could not draw benefits from my spouse, because I had not worked 30 yrs under Social Security. Each new proposal by OPERS has the potential to reduce retirement income. If the Windfall Offset was changed /removed at least it would help .

We’re sorry, Mary. Our intention was not to frighten you but to provide as much transparency as possible and highlight the challenges we face. Please know your pension is secure.

GPO and WEP are federal laws that impact public workers in Ohio and 25 other states because we do not pay into Social Security. OPERS continues to advocate for the repeal or reform of GPO and WEP in Congress. Ultimately resolving that issue is in the hands of our representatives in Washington.

We published a blog on WEP that you may find interesting, https://perspective.opers.org/index.php/2017/04/04/supporting-solutions-to-the-wep-issue/.

Julie, OPERS